As of January 1, 2025, 10 states changed their income tax codes. Nine of those states reduced their tax rates, and one no longer taxes earned income. Find out what that means for you.

Key Takeaways

- Indiana, Iowa, Louisiana, Mississippi, Missouri, Nebraska, New Mexico, North Carolina, and West Virginia are reducing their tax rates effective Jan. 1, 2025.

- Nine states, now including New Hampshire, don’t tax earned income at all.

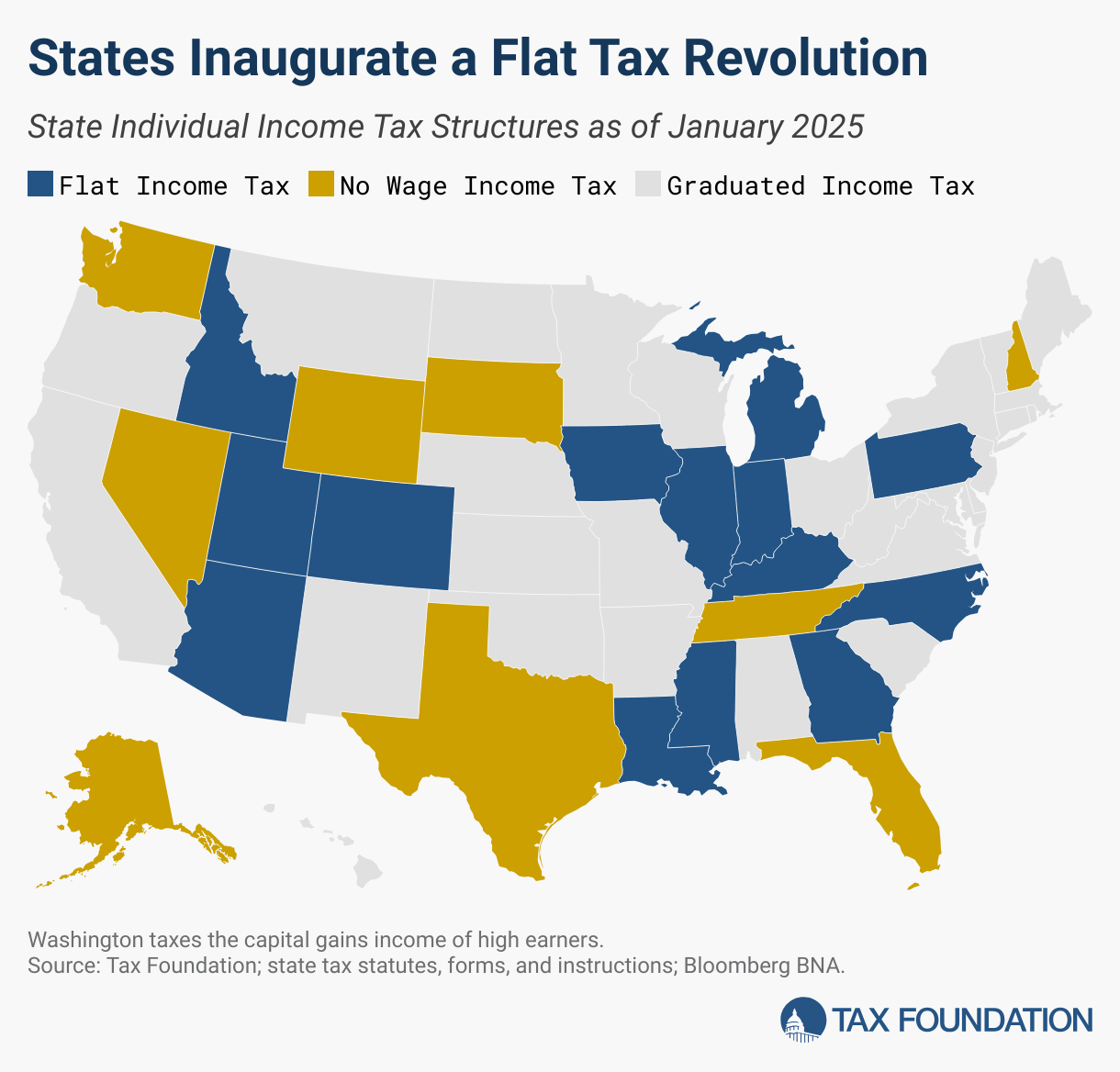

- Fourteen states impose a flat, single tax rate on all income, and 29 have a marginal income tax rate, meaning the more you earn the more you pay.

What’s New in 2025?

In 29 states and Washington, D.C., residents must pay marginal income tax rates. That means that in these states, the more you earn, the greater the percentage you’ll pay on your top dollar. This stands in contrast to a flat tax, which is a single rate that applies to everyone and to all of your dollars, no matter how much you earn.

Kansas has twice attempted to change over to a flat tax rate but its governor vetoed the proposal in 2023 and again in 2024. The state still has a marginal tax rate in 2025. Georgia and Pennsylvania converted to flat tax rates early in 2024. Louisiana did the same in November 2024. New Hampshire’s previous tax on dividend and interest income is no longer effective starting in 2025, meaning it joins the ranks of the states that do not tax income. And Iowa is converting to a flat tax rate beginning in 2025.

Nine states reduced their tax rates effective Jan. 1, 2025. Some have flat tax rates and some impose marginal rates:

- Indiana

- Iowa

- Louisiana

- Mississippi

- Missouri

- Nebraska

- New Mexico

- North Carolina

- West Virginia

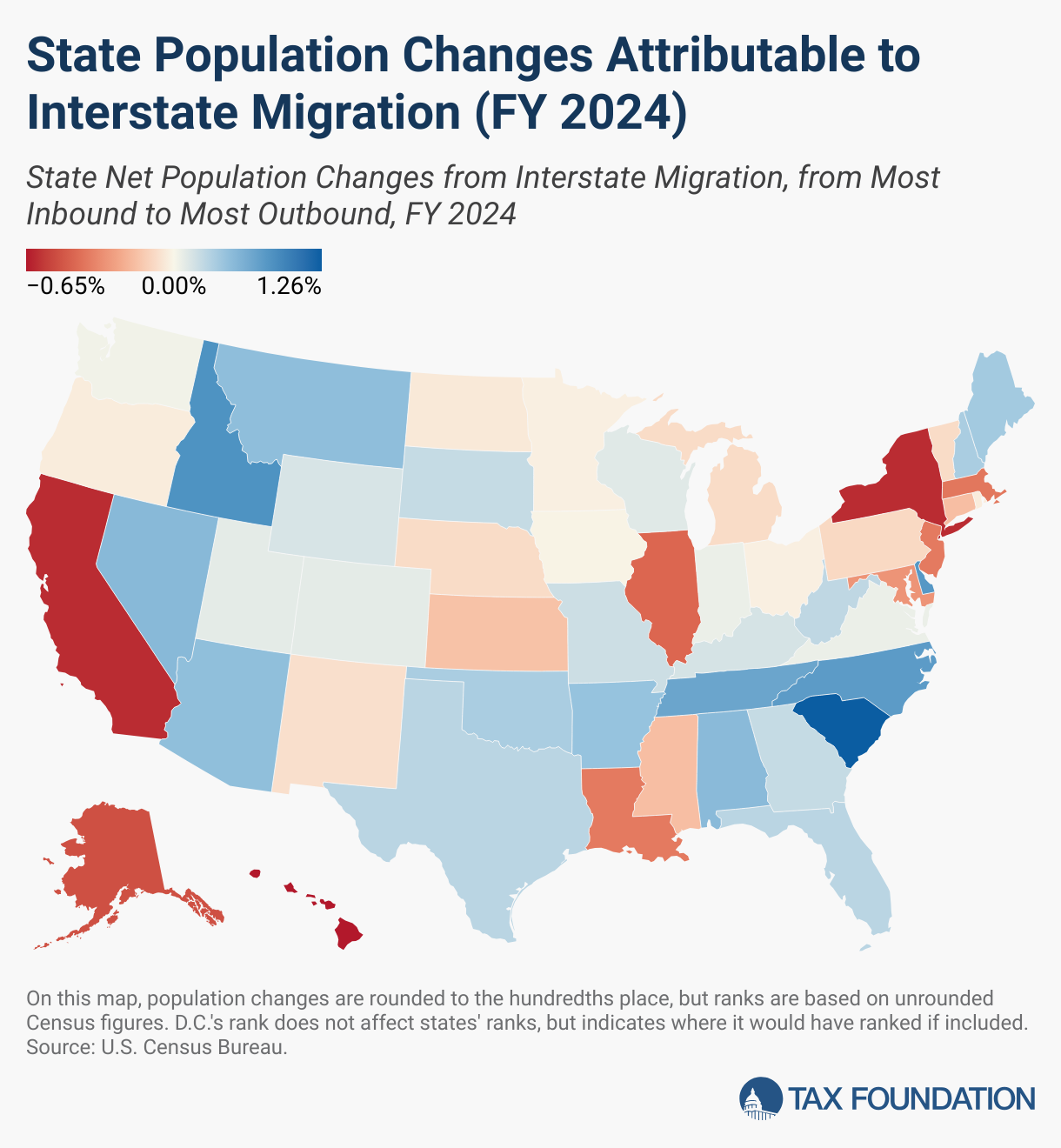

According to the Tax Foundation’s 2025 State Tax Competitiveness Index, Wyoming is the best state to live in, taxes-wise, while New York is the worst.

Top State Income Tax Rates

What will you pay in your state? These are the top tax rates in each state as of tax year 2025.

| Top State Income Tax Rates of 2025 | ||

|---|---|---|

| Alabama | 5.00% | |

| Alaska | 0.00% | |

| Arizona | 2.50% | |

| Arkansas | 4.90% | |

| California | 13.30% | |

| Colorado | 4.40% | |

| Connecticut | 6.99% | |

| Delaware | 6.60% | |

| District of Columbia | 10.75% | |

| Florida | 0.00% | |

| Georgia | 5.75% | |

| Hawaii | 11.00% | |

| Idaho | 5.80% | |

| Illinois | 4.95% | |

| Indiana | 3.00% | Effective Jan. 1, 2025 |

| Iowa | 3.80% | Effective Jan. 1, 2025 |

| Kansas | 5.70% | |

| Kentucky | 4.50% | |

| Louisiana | 3.00% | Effective Jan. 1, 2025 |

| Maine | 7.15% | |

| Maryland | 5.75% | |

| Massachusetts | 9.00% | |

| Michigan | 4.25% | |

| Minnesota | 9.85% | |

| Mississippi | 4.40% | Effective Jan. 1, 2025 |

| Missouri | 4.70% | Effective Jan. 1, 2025 |

| Montana | 6.75% | |

| Nebraska | 5.20% | Effective Jan. 1, 2025 |

| Nevada | 0.00% | |

| New Hampshire | 0.00% | Effective Jan. 1, 2025 |

| New Jersey | 10.75% | |

| New Mexico | 5.90% | Effective Jan. 1, 2025 |

| New York | 10.90% | |

| North Carolina | 4.50% | Effective Jan. 1, 2025 |

| North Dakota | 2.64% | |

| Ohio | 3.99% | |

| Oklahoma | 4.75% | |

| Oregon | 9.90% | |

| Pennsylvania | 3.07% | |

| Rhode Island | 5.99% | |

| South Carolina | 6.50% | |

| South Dakota | 0.00% | |

| Tennessee | 0.00% | |

| Texas | 0.00% | |

| Utah | 4.85% | |

| Vermont | 8.75% | |

| Virginia | 5.75% | |

| Washington | 7.00% | |

| West Virginia | 4.82% | Effective Jan. 1, 2025 |

| Wisconsin | 7.65% | |

| Wyoming | 0.00% | |

Sources: Tax Foundation and Tax-Rates.org

States With a Flat Tax Rate

Fourteen states fall into the flat-tax category:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Massachusetts

- Michigan

- North Carolina

- Pennsylvania

- Utah

Mississippi doesn’t make the list but it falls into a gray area. This state technically has two income tax rates but one of them is 0%. It applies to income under $10,000. All income over $10,000 is taxed at 4.4% as of 2025.

States with No Income Tax

Some are lucky enough to reside in one of the nine states without an income tax. The nine income-tax-free states as of 2025 are:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Wyoming makes the list because this state doesn’t tax earned income, only capital gains.

The Bottom Line

The extent of your state-level tax bill varies depending on where you live. Some states impose a single, flat tax rate. Others tax your top dollars at a higher percentage as you earn more. A few have no income tax at all.

State tax liability can be further complicated by states changing their tax codes from one year to the next. Be sure to do your research before you prepare your 2024 state tax return and do your homework so you can do effective tax planning for 2025.

Leave a Reply