The following article from Patrick Gleason, ATR Vice President of State Affairs, was originally published in Forbes.com:

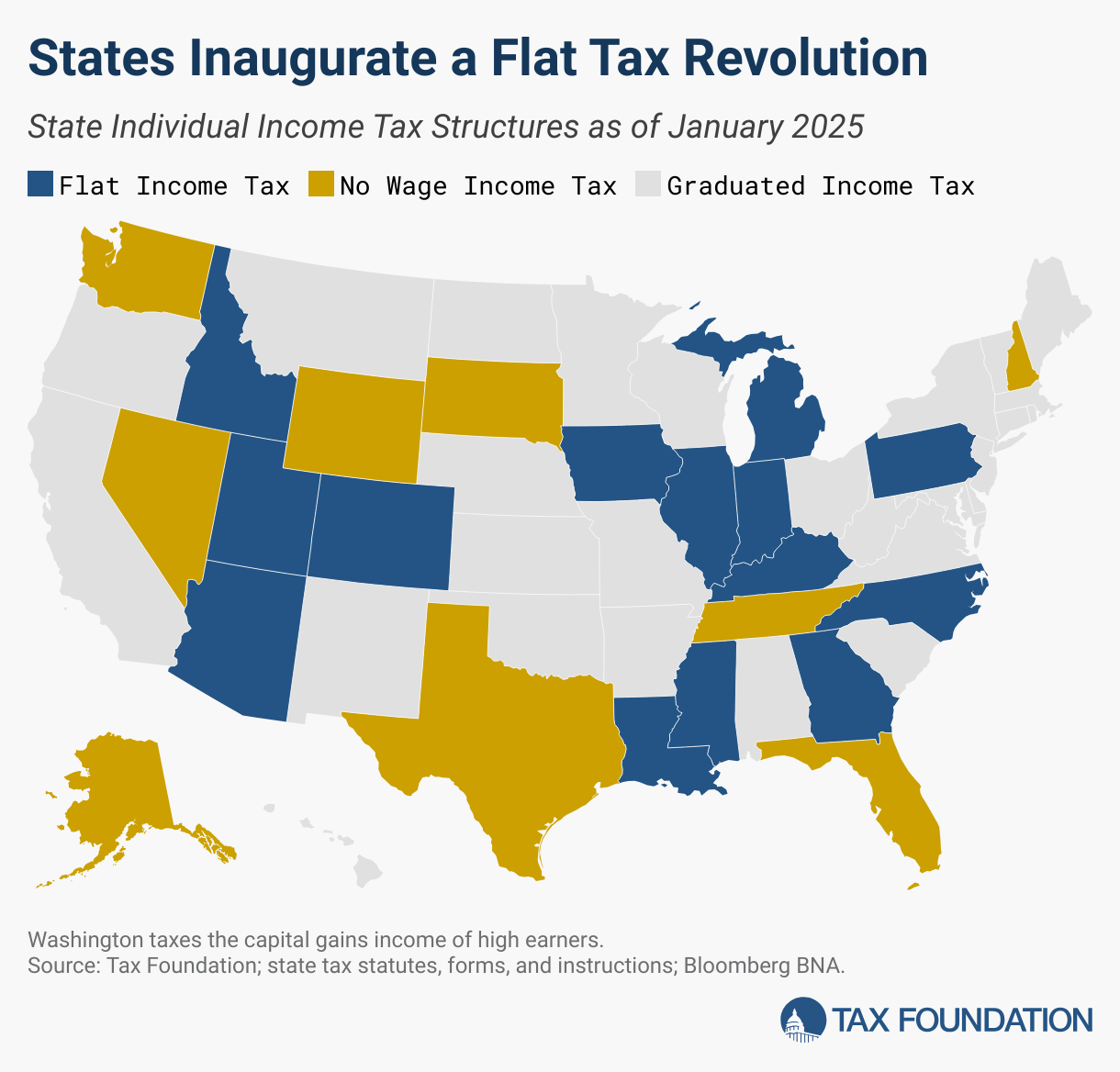

The number of states with a flat rate income tax has grown by more than 50% over the past decade, rising from nine in 2013 to 14 in 2024. On New Year’s Day 2025, the ranks of flat income tax states will grow by two.

Among the new flat tax states in 2025 is Iowa. Under the leadership of Governor Kim Reynolds (R), the Hawkeye State moved from a progressive income tax system with a top rate of 8.98% to a 5.7% top rate in 2024. On January 1, 2025, Iowa shifts to a 3.8% flat income tax. Iowa’s inheritance tax also completes a phaseout that legislators approved in 2021.

On the first day of 2025, Louisiana moves from a graduated income tax with a bottom rate of 1.85% and a top rate of 4.25%, to a 3% flat income tax in accordance with legislation enacted by Governor Jeff Landry (R) in early December. Some states that have already adopted a flat tax will see their rate lowered in 2025. Indiana, for example, will also have a 3% flat income tax take effect on January 1, 2025, with the rate coming down from 3.05%. Indiana’s flat income tax is scheduled to fall again in 2027 to 2.9%.

In North Carolina, meanwhile, the state’s flat income tax drops from 4.5% to 4.25% on January 1, 2025. A year later, at the start of 2026, the rate will fall again to 3.99%.

North Carolina, in addition to being one of the nine states with a personal income tax cut taking effect at the start of 2025, is one of three states where a corporate income tax cut becomes effective. North Carolina’s corporate income tax will fall from 2.5% to 2.25% on January 1, 2025 and is scheduled to phase down to zero by 2030.

To continue reading, click here.

Leave a Reply