The Gazette offers audio versions of articles using Instaread. Some words may be mispronounced.

The start of a new year also means the start of new laws in Iowa, including a new and lower state income tax rate, new restrictions for those convicted of drunken driving and a new data privacy law.

Iowa lawmakers in 2024 passed and Gov. Kim Reynolds signed more than 180 laws. Most took effect July 1, the beginning of the state fiscal year. However, a handful will go into effect with the start of the new year.

Here is a look at some of the notable new laws that take effect Wednesday.

Lower, flat state income tax rate

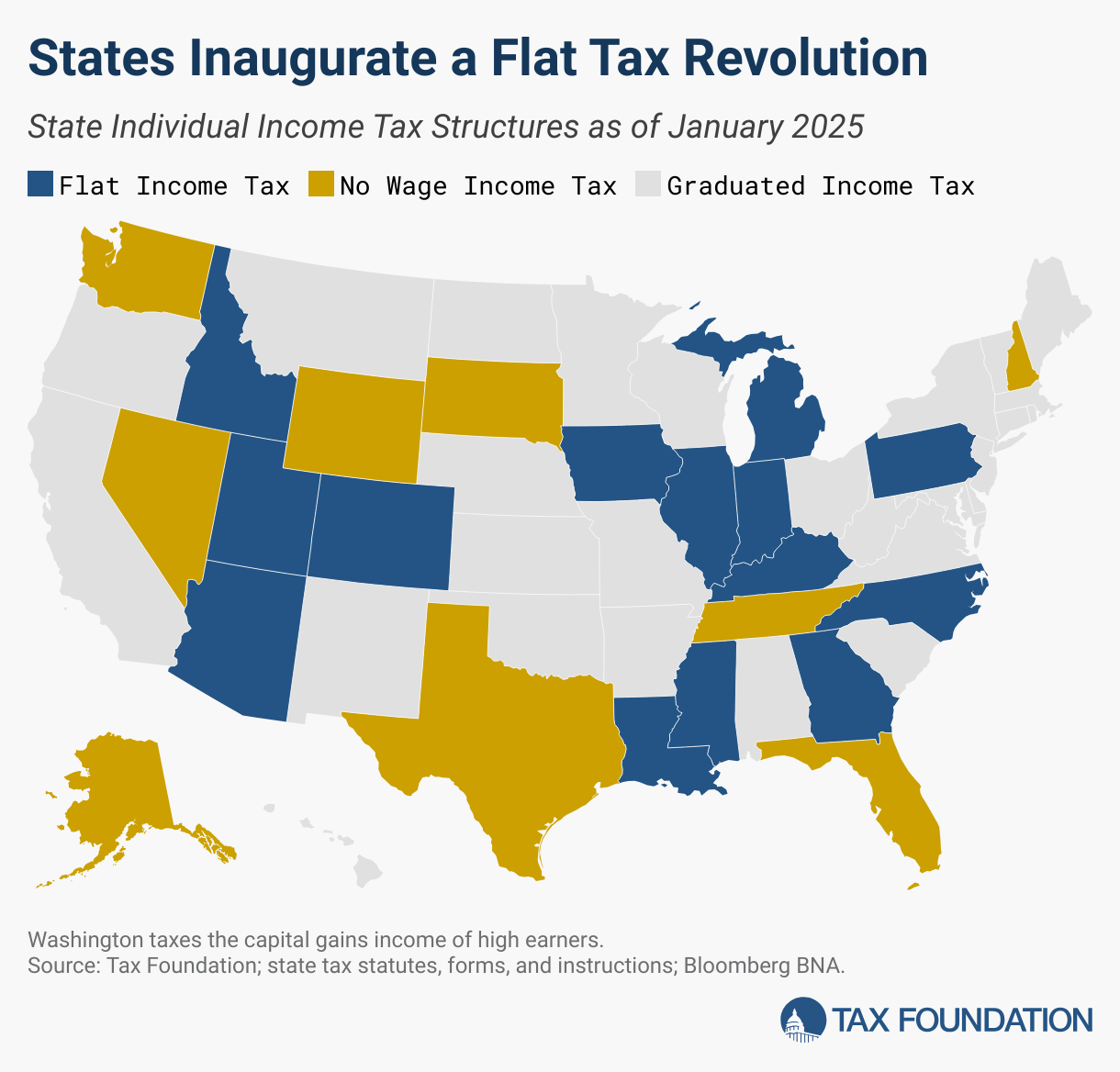

Iowa’s top individual income tax rate will drop from 5.7 percent to a 3.8 percent flat rate for all taxpayers. The new law, Senate File 2442, accelerates a 2022 income tax overhaul that would have taken Iowa to a 3.9 percent flat tax by 2026.

Republicans — who have had complete control of the state lawmaking process since 2017 — have gradually reduced the number of state income tax brackets and lowered rates to make Iowa more competitive. With the change, Iowa will have the sixth-lowest state income tax rate in the country. Nine states have no income tax for individuals.

GOP lawmakers have also pointed to annual budget surpluses as evidence Iowans are paying too much in taxes.

In 2023, there were four tax brackets ranging from 4.4 to 6 percent, and in 2024 there were three brackets ranging from 4.4 to 5.7 percent. In 2025, most working Iowans will pay a flat 3.8 percent state income tax rate.

Iowa’s nonpartisan Revenue Estimating Conference projects personal income tax revenue will fall by about $665 million — a 12 percent drop — in the coming budget year.

If tax receipts come in below what the Legislature spends in any year over the next five years, the new law states that half the difference would come from the state’s Taxpayer Relief Fund.

An analysis from the nonpartisan Legislative Services Agency estimates the new law will reduce Iowa income taxes — and thus state revenue — by more than $1.3 billion over six years.

Statehouse Republicans have said they’re confident the state budget can withstand the projected revenue reductions, noting Iowa has a $2 billion budget surplus, $961 million in its reserve accounts and $3.75 billion in the Taxpayer Relief Fund.

Democrats and Common Good Iowa — an Iowa-based nonprofit research and advocacy organization focused on the well-being of children, families and workers — contend the tax cuts are unsustainable, leaving less ongoing revenue to invest in students, health care and other critical services and disproportionately benefit the wealthy.

New consumer data protections

A 2023 Iowa Data Privacy Law takes effect Wednesday.

The law, Senate File 262, allows Iowa consumers to confirm whether their personal data is being collected; get a copy of their data; delete their data; and opt out of the sale of personal data. It also requires businesses to secure personal data and be transparent over how its processed and whether it is shared or sold to third parties.

The bill requires companies that meet a certain threshold to notify consumers of their data collection practices and provide them with the data upon request.

The law does not apply to personal data controlled or processed by state and local government agencies, financial or higher education institutions, and data related to health records and information collected for research.

Iowa businesses that meet the threshold must provide all Iowa consumers with a privacy notice that includes the categories of personal data processed, the purpose for processing personal data, categories of personal data shared with third parties and who the third parties are, the consumer’s rights and the process for exercising those rights.

If a company sells data or uses targeted advertising, it is required to disclose that and allow users to opt out.

The Iowa Attorney General is responsible for enforcing provisions of the new law, which carries a civil penalty of up to $7,500 per violation.

Extended postpartum Medicaid coverage

New mothers in Iowa who qualify for Medicaid will receive a full year of postpartum care, but fewer women will qualify for the assistance under Senate File 2251.

The law extends coverage from 60 days to 12 months after a pregnancy ends. Iowa is one of the last states to enact the extension, which was made available to states under the 2021 American Rescue Plan Act.

The state law also tightens the income threshold for a pregnant woman to qualify for Medicaid, from 375 percent of the federal poverty line to 215 percent of the poverty line. The new requirement is equivalent to about $43,900 for a single mother and $67,100 for a family of four.

An estimated 2,700 women who would otherwise have lost their postpartum coverage after two months will be covered for the full 12 months, according to a Legislative Services Agency analysis. But about 1,700 fewer Iowa mothers and infants will be covered each month in order to make the change cost-neutral.

Republicans say the proposal expands postpartum care for low-income Iowans who need it most. Democrats argued the lower income eligibility was unnecessary and would be a financial burden on new parents who will no longer be covered for birth and postpartum expenses.

Changes to Iowa OWI laws

Changes aimed at improving Iowa’s ignition interlock law for those convicted of drunken driving also take effect Wednesday.

A person whose driver’s license is revoked for operating while intoxicated is required to install the device before being issued a temporary restricted license, allowing them to drive to and from work, school, the doctor and court under certain conditions.

Drivers must complete the designated time period without violations before the device can be removed and their driver’s license reinstated. Senate File 2261 adds compliance-based removal provisions, extending the amount of time a person is required to maintain an ignition interlock device on their vehicle if there are multiple violations detected by the device.

The law also makes it a serious misdemeanor to remove a device without permission. It also requires the Iowa Department of Transportation to revoke the driver’s license of a person required to maintain an ignition interlock device who does not get one installed or removes it without authorization.

Supporters say the legislation is critical to reducing impaired driving in Iowa.

Individuals can waive the requirement to install an interlock device for a “verifiable medical condition” that makes the person incapable of properly operating the device. Those under the age of 18 cannot obtain a temporary license after a license revocation. The prohibition previously applied to anyone under the age of 21 whose driver’s license was revoked.

The new law states only vehicles a person drives need to have an ignition interlock device, rather than every vehicle they own, with some exceptions. It also establishes in code the alcohol concentration beyond which a device will not allow the operation of the motor vehicle at 0.04.

For someone with a second or subsequent OWI revocation, the device must be installed for at least one year after their driver’s license is reinstated. That time can be reduced if the driver held a temporary restricted license while using an ignition interlock device.

Non-medical prescription switching

Insurers in the state will no longer be able to force stable patients to switch midyear from their current medications to an insurer’s “preferred” drug for non-medical reasons.

The law curtails the practice of non-medical switching, where patients are forced to pause, change or stop their medication for non-medical, commonly cost-saving reasons because their insurer stopped covering it.

House File 626 prevents insurers from ceasing to cover a medication in the middle of a calendar year when it already has been prescribed and approved by their health plan, unless there is a medical reason for doing so.

Under the new law, a carrier or organization cannot limit or exclude coverage of a prescription drug if the person is medically stable on the drug, it was previously approved for them and it was prescribed within the last six months. The law prevents carriers from reducing drug benefit coverage, increasing cost sharing, moving a drug to a more restrictive tier or removing it from a formulary, except under specific circumstances. It allows substitutions for drugs with the same generic name, and does not prevent a health care professional from prescribing another necessary drug.

Insurers say the practice is necessary to control the costs of medications and keep premiums down. Patient advocacy groups and health providers contend that when treating certain health conditions like mental illness, a forced medication change can be detrimental and undercuts treatment decisions made between doctors and patients.

While some medications may be used to treat the same condition, substituting one for another can result in the reemergence of symptoms, new side effects or negative drug interactions, some research shows.

“Mental health treatment is complex and studies show that medications in the same class for the treatment of mental illness are not interchangeable the way medications in other classes may be,” according to Mental Health America.

Increase in vehicle registration, title fees

Iowans will pay $10 more to register and title their vehicles in the state.

House File 674 increases by $10 various fees required in the registration and titling of vehicles, including establishing a $10 increase in the fee for new registration. Applications for initial registration and issuance of a certificate of title for a vehicle, as well as applications for a replacement copy of a title, a new title upon transfer and more, will increase from $20 to $30.

Applications for certificates of title by a dealer for a foreign registered vehicle will increase from $5 to $15.

The act also outlines the amount of fees county treasurers can retain to deposit in the county general fund.

New ‘bong tax’

Iowa stores that sell paraphernalia commonly used to smoke marijuana and other drugs will face new regulations and higher taxes.

Products that are sold and used to inhale tobacco products — like glass and metal bongs and pipes — will be taxed at 40 percent. The tax revenue will be used to create a fund for specialty courts and diversion programs designed to address substance and mental health issues.

Senate File 345 also requires retailers to obtain a license in order to sell the products, giving cities and counties the authority to approve permits. Retailers would need to pay a $1,500 permit fee annually to sell the devices — defined as “any equipment or product, made in whole or in part of glass and metal, that is designed for use in inhaling through combustion tobacco, hemp, other plant materials, or a controlled substance.”

The law bans the sale of such products to anyone under the age of 21, and establishes civil penalties for the willful violation of the law and its requirements.

Gazette reporters Erin Murphy and Bailey Cichon contributed to this report.

Comments: (319) 398-8499; [email protected]

Leave a Reply